In search of a personal loan that you can use for any purpose and that you can access right away? How about one that offers optimal manageability? While there are many different loan options on the market today, we know of one that may just fit these needs perfectly.

With their various loan offers, Barclays may have the right option for you. The Barclays Online Personal Loan offers money to borrowers quickly and in a hassle-free manner.

To learn more about the Barclays loan, continue reading this article. This article will discuss all of the important information to consider before you choose whether or not to apply for this personal loan.

Barclays Online Personal Loan Features and Benefits

The Barclays personal loan offer is a good way to fulfill any financial needs including business capital, investments, timeshares, property purchases, gambling-related expenses, repaying county court judgments, and other expenses. Individuals with a lot of varied financial needs can benefit from this kind of flexibility.

If you are getting a loan to fund emergencies or sudden expenses, you will be glad to know that you can access your funds within minutes.

The application process takes as little as 10 minutes. Once your print or download the agreement between 7 am and 10:30 pm, you can get your money right away.

For those concerned about manageability, this is a good option as you can predict your payments through its fixed repayment system. Moreover, you can monitor your loan using their mobile applications as well. In addition, you are able to pay your loan off early at any time that suits you for a fee.

Getting a Barclays Online Personal Loan

Interested in getting this loan? You are in for a fast and easy treat because their online application system can be completed within minutes.

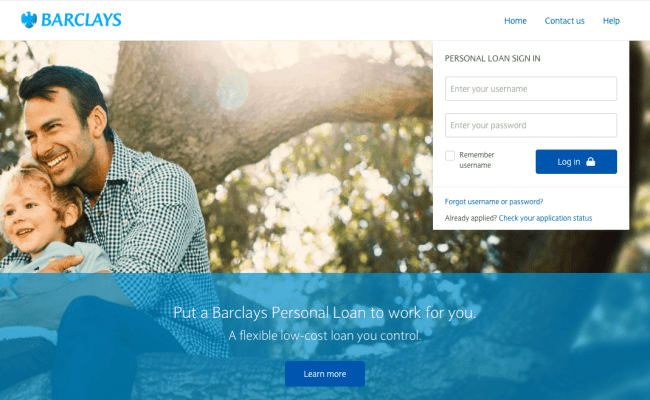

To start your application, just visit the Barclays website. You need to have a Barclays current account, UK residency and must be 18 years old and above.

Their online application form will prompt you to provide your membership, card, or sort code and account number. You will also need to present your identification details.

When you apply, you will need to enter the amount you want to borrow and the number of months you want to pay it back in. You can choose a loan amount between GBP 7,500 to GBP 15,000. For your loan term, you can choose between 24 months to 60 months.

Barclays Online Personal Loan Fees and Charges

One of the best things about this loan is its fixed repayment system. The bank assigns your repayment amount based on your loan amount and term, as well as your annual percentage rate. To get your APR, the bank will evaluate the details you provide and will assign an APR based on their findings.

As a representative example, however, a GBP 10,000 loan payable in 60 months will have a representative APR of 5.5%. If you choose to get this loan, you will be paying GBP 190.39 every month.

This results in GBP 11,423.40 total payable amount. To test various combinations of loan amounts and terms, visit their website, and use their loan calculator.

Keep in mind that if you choose to make early settlements, you will need to pay a fee. There are no origination or late fees.

How to Contact Barclays

If you have questions or simply want to hear more about this loan, you can also talk with Barclays directly.

Barclays can be reached by phone at 0800 716 598 or you can stop by their head office, located at 1 Churchill Place, London, ENG E14 5HP. Alternatively, you can access Barclays’ 24/7 chat support by visiting their website.

Conclusion

When getting a loan, nothing beats being able to get your money in just a short whilst. With the added predictability and affordability, you can never go wrong with Barclays Online Personal Loan.

To know more about this offer, visit their website, or get in touch with their representative and get your application going today.

Note: There are risks involved when applying for a loan. Consult the lender’s terms and conditions page for more information.