If you are unhappy with your Progressive insurance and wish to cancel it, do not worry about it. The cancellation process is fairly easy. It is, however, important to do it at the right time. This would be when you do not owe any extra fees to the company.

Progressive insurance has many advertisements that make it clear how easy it is for you to switch and save. Canceling the policy, however, is based on where you live and if you are in the US. This is because each state has its own rules and regulations concerning these kinds of cancellations.

Regardless of where you are, it is always a good idea to line up a new insurance policy before canceling the existing one. Now, if you have been wondering how to cancel your Progressive insurance policy, here us how you can do it.

Cancel At The Right Time

It is possible to cancel services at one insurance company for another, as we have mentioned above. However, timing is essential. The following are the best times to do this

You can consider canceling your service three to four weeks before the renewal of the current policy. However, this depends on the laws of where you live. You should receive a renewal notice one month before the renewal is set to take effect. Use this information to compare the products and rates of competitors. This way, you can ensure you have the best rates on the market.

Weigh all insurance options available after a significant life event such as a divorce, marriage, buying a new home or car, or the birth of a child. Contact the new company to see how such changes can affect the policy and rates, then use this information to evaluate your options.

Check The Current Progressive Cancellation Policy

You may be surprised to note that some companies will charge you cancellation fees. Ensure you understand these terms well so you do not end up paying a cancellation fee to end your policy before the renewal date. In most cases, however, the fee is usually 10% of the outstanding premium.

Again, investigate the refund policy. You should receive a refund for the unused amount of your policy, minus any fees.

Choose A New Policy

In the US, each state usually has an insurance requirement for motor vehicles that you are required to follow. One of these laws is ensuring that you have a new insurer in place when you cancel your current policy. Shop around and compare the costs from different companies. This way, you can find the most economical policy and one that offers you the best benefits.

Ask Your New Insurer For Help

Some insurance companies are eager to get new business, and hence, they are more than willing to help their clients with canceling their previous policies. When your new insurance company does the work, you may only need to sign a paper to switch policies.

Mail The Canceled Policy Form

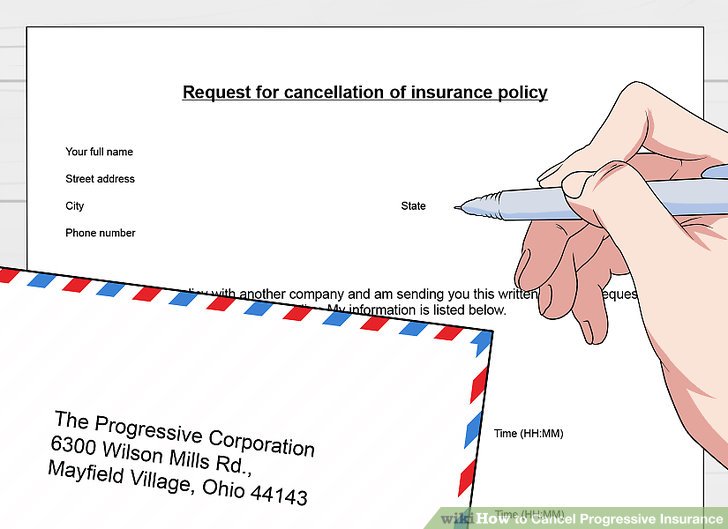

In most US states, you are required to fill in a form and sign it in order to cancel an existing Progressive insurance policy. This is usually the simplest method of cancellation, and you can find pre-made forms online that you can fill out.

These forms should include the following.

- Your name, telephone number, and address

- Your current Progressive policy number

- The time and date you wish to end it

- The insurer’s name, start and end time of the new policy and the new policy number.

- Your signature should be dated

You can then mail this to The Progressive Corporation, Mayfield Village, 6300 Wilson Mills Rd. 444143 Ohio. Do this at least one or two weeks before the cancellation date.

Other Important Things To Note

- You must follow the rules that have been stipulated for each state, in order to ensure a smooth cancellation process. If you complete the cancellation right before it’s due, you will be required to call customer service and officially cancel the policy.

- Most insurance companies automatically renew policies. If you do not tell them that you are canceling, you will end up with premiums that are overdue, since you had no idea that the policy was still running. This is why you are advised to cancel 2-3 weeks before the current policy is due.

- Before making any steps towards the cancellation of the current policy, ensure you have compared the rates of all insurance companies, so you can get the best possible rate.

Conclusion

Remember that different states have different rules. It is, therefore, important to ensure that you follow all the rules so you do not run into difficulties when trying to cancel your insurance policy.